How do customers react to price changes? The key figure price elasticity records in figures the effects that price reductions and increases have on the purchasing behaviour of consumers.

When prices rise, sales fall, when prices fall, sales rise. What seems logical is a bit more complicated in practice. The relevance of this simple formula depends, among other things, on the price elasticity. A thorough knowledge of this parameter can help you set your own prices.

Table of contents

- What is price elasticity?

- Distinction between the price elasticity of supply and demand

- How to calculate price elasticity

- How to use price elasticity?

Price elasticity – definition

The direct price elasticity is, according to Gabler Wirtschaftslexikon the “ratio that measures the relationship between the relative change in demand for a good and the relative change in the price of the same good (and thus, unlike cross-price elasticity, direct) that triggers it.”

In contrast, according to Gabler, a cross-price elasticity refers to the “measure of the percentage change in sales of one good when the price of another good changes. In the case of a strong substitution relationship between two products, there is typically a (strongly) positive cross-price elasticity, i.e. a fall in the price of one product leads to a fall in sales of a similar product […]”.

In simpler terms, “direct price elasticity” refers to a single good whose price is changed. Cross-price elasticity’ shows how the change in price of one product affects another product whose price has remained unchanged. For both, the more the purchasing behaviour changes, the higher the price elasticity.

.

Between supply and demand

It is not only consumers who react to market price changes, but also suppliers. This is why we talk about both the price elasticity of demand and the price elasticity of supply.

The price elasticity of demand

In the case of the price elasticity of demand, which is much more discussed than the price elasticity of supply, we examine how consumers respond to price changes. In principle, a increase in prices leads to a decrease in demand. A price decrease increases demand. In this case, the direct price elasticity tells us by what percentage the demand for the good in question changes.

If we get a value greater than 1, the demand for that good is elastic. If the value is less than 1, the demand is inelastic. This means that the price varies more than the demand. Consumers therefore react little or not at all in their purchasing behaviour to a change in price. This is typically the case for basic foodstuffs and other necessities. However, there may be exceptions, as shown by the Giffen paradox (see box). The term perfectly inelastic is used when the resulting value is zero.

The Giffen paradox

The paradox of the Giffen case lies in the fact that consumers react to a price change in a different way than seems logical. In the time of the Scottish economist Robert Giffen, in the 19th century, a rise in the price of bread caused the poor to buy more bread than before.

The reason was that precarious workers could no longer afford to buy more expensive supplementary foods, such as milk and meat, because of rising prices. As they were practically eating only bread, the demand for bread increased despite the price increase. Bread is therefore part of what is known as the Giffen goods.

Robert Giffen was long considered the author of the description of this behaviour. This has since been questioned, but the paradox remains associated with his name.

In addition to the direct price elasticity mentioned above, the indirect price elasticity or cross price elasticity also has an impact on demand. In this case, we are dealing with a change in the price of another good that affects our own product. In this context, we speak of complementary goods that complement our good and substitute goods that replace our good.

The effect is generally as follows: If the price falls, the demand for that good increases along with the demand for the goods that complement it. Example: a fall in the price of shoes will stimulate not only their sales, but also those of shoelaces, shoe polish, brushes and shoe trees.

Conversely, a price increase only increases the demand for substitute products, i.e. competing products. The extent to which the cross-price elasticity applies depends strongly on the availability of complementary and substitute goods.

The price elasticity of supply

This refers to how supply responds to changes in market prices. Price elasticity indicates the relationship between changes in prices and changes in supply. Normally, when the price of a given good increases, the supply of that good also increases, and when the price decreases, the supply decreases accordingly.

Again, the magic number is 1. If the value is lower, we are dealing with inelastic supply, if it is higher, with elastic supply. So when supply is inelastic, suppliers do not react to price changes.

The response also depends on the degree of capacity utilisation. For example, if capacity is full, production cannot be increased in the short term. If there is no reaction from suppliers, we are talking about a totally inelastic supply. Strategic considerations may also be at the root of this situation.

Calculating price elasticity

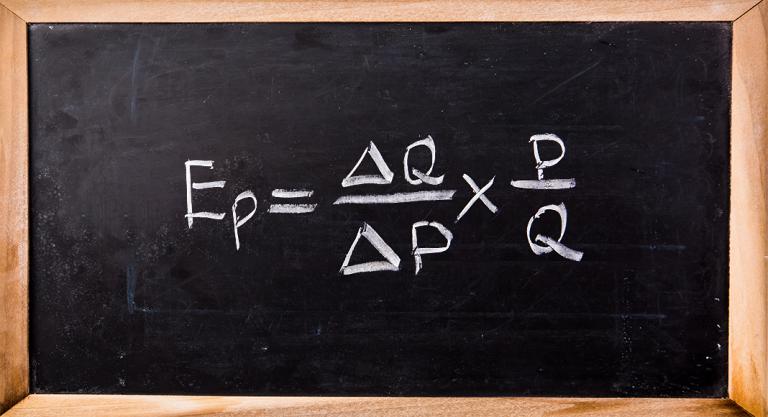

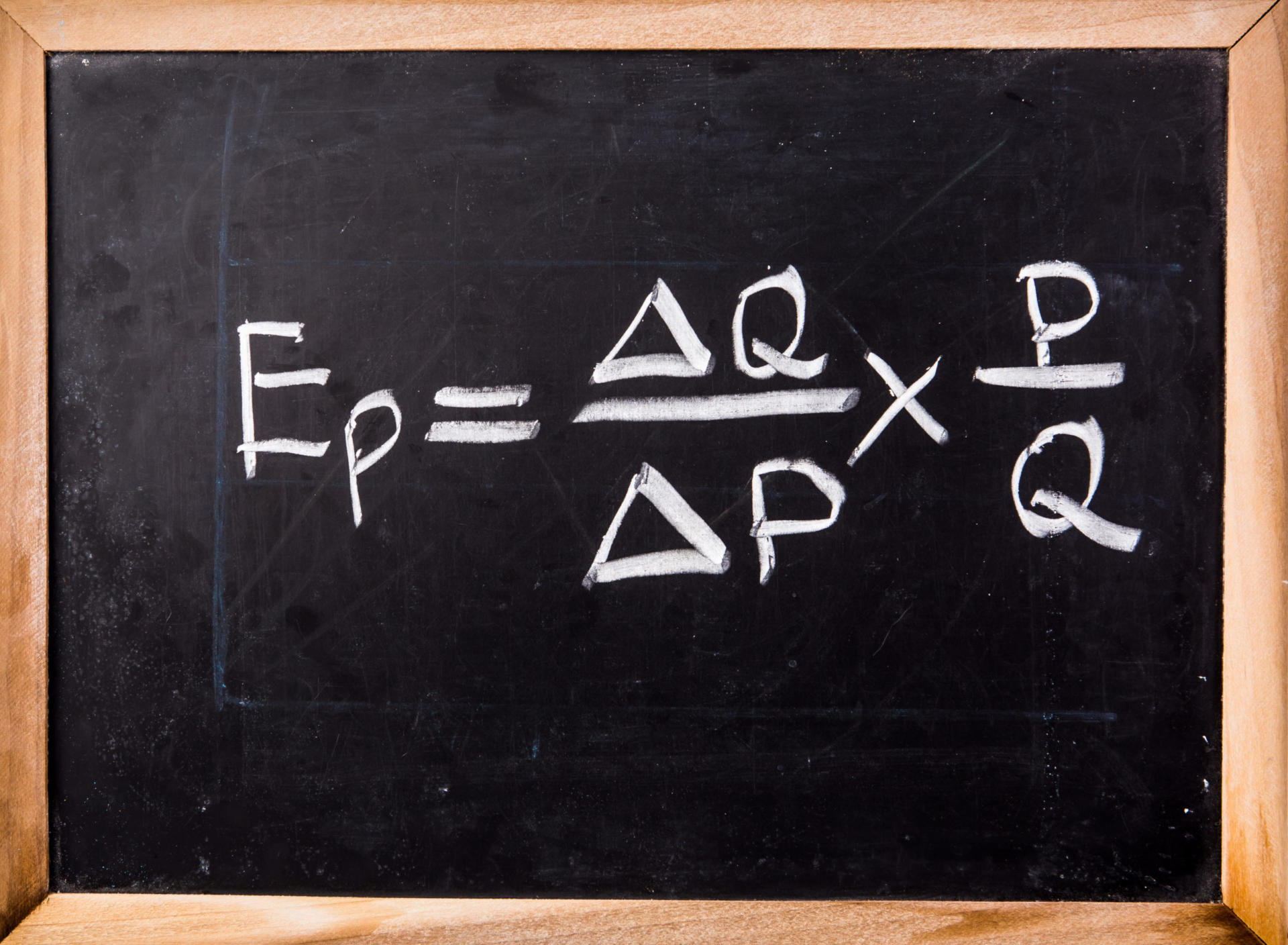

As mentioned, a value greater than 1 indicates high price elasticity and a value less than 1 indicates low price elasticity. We calculate this ratio by dividing the percentage change in demand by the percentage change in price.

Price elasticity formula

The simplest formula for calculating the price elasticity of demand is as in the diagram.

- E = elasticity

- p = price

- Q = quantity of demand or supply

- Δ = percentage change

Δp calculate by subtracting the original price from the new price.

ΔQ is calculated by subtracting the original quantity from the new one.

The original price and quantity are in the second division.

Price elasticity – Examples

Suppose we sell towels at €3 each. Each month, 300 of these towels are sold. After a price increase to €5, we sell only 200. The elasticity calculation is then as follows:

((300 – 200) : (5 – 3)) x (3 : 300)= 0.5.

This value is significantly less than 1, which means that demand is inelastic. The price therefore varies more than the quantity. Thus, price does not have as great an impact on sales. If we assume that the quantity sold is reduced to 100 by the price increase, we reach a value of 1. If the quantity were to fall further, demand is elastic.

Use in practice

Any entrepreneur pursuing a strategic pricing policy as part of their pricing policy should orient themselves towards price elasticity. Ideally, knowledge about this is already used in price formation. This is obviously not based on personal experience at the time of creation, but can be based on observation of the competition and market research data.

These two points also play a role later on, as they always complement internal knowledge. Precise knowledge of price elasticity helps to take a new strategic direction if, for example, sales develop differently than expected. Entrepreneurs can thus assess in advance with some accuracy how customers will react to price changes. They can thus calculate that if prices are increased, total turnover will not be lower than before due to lower sales.

The magnitude of the price elasticity also depends on the nature of the goods. In general, luxury goods are much more elastic than expendable consumer goods. The greatest scope for a strategic pricing policy is therefore offered by products and services that are not necessarily needed per se, or at least in a premium version.

Sources: Gabler Wirtschaftslexikon (https://wirtschaftslexikon.gabler.de)

Image sources: Shutterstock